The advantages of pattern trading technique

You’ll enjoy it due to the fact that it:

- Boosts your win price

- Supplies a far better danger to compensate

- Can be used throughout any kind of markets

Allow me clarify …

Fad trading enhances your win price

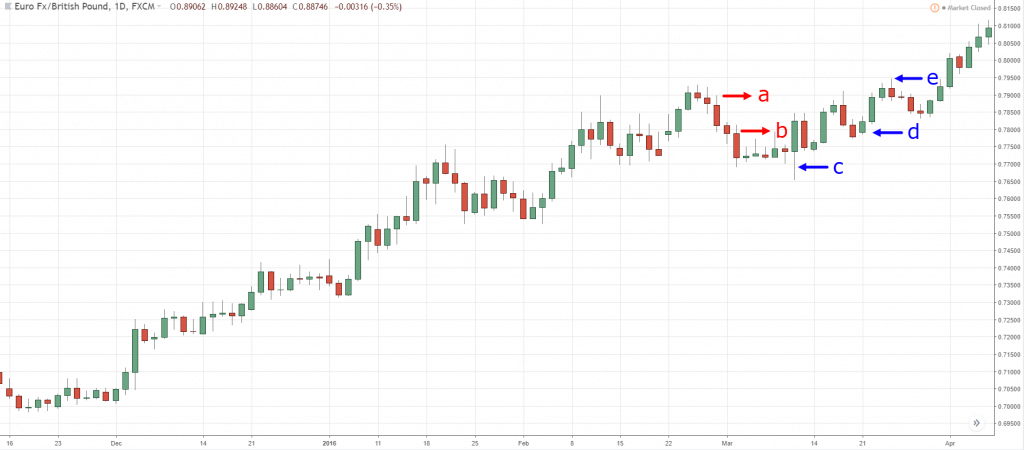

There are 5 factors in this graph: A, B, C, D, as well as E.

Currently ask on your own … Do you wish to purchase C, D or E? Or go short at A or B? Possibilities are, you’ll choose C, D or E due to the fact that the relocation last much longer and also you have a greater possibility of winning. Uses a much better danger to award Besides raising your win price, pattern trading likewise boosts your threat to compensate

. Right here’s what I indicate:

This suggests for each $ 1 you run the risk of, you might make a several of that quantity( like$2,$ 3, and even$ 10). Pattern trading can be used throughout any kind of markets Below’s things: Patterns exist as a result of greed and also anxiety on the market. When there’s greed, you’ll obtain even more purchasing stress, which causes greater rates( an uptrend ). When there’s anxiety, you’ll obtain even more marketing stress, which causes reduced rates( a sag). You’re possibly questioning:” Will trend trading quit working?” Just if people have no feeling( which is not likely ). Therefore, you can anticipate fads to happen in any type of markets like foreign exchange, futures, supplies, bonds, farming, and so on 30-Year Treasury Bond:

This suggests for each $ 1 you run the risk of, you might make a several of that quantity( like$2,$ 3, and even$ 10). Pattern trading can be used throughout any kind of markets Below’s things: Patterns exist as a result of greed and also anxiety on the market. When there’s greed, you’ll obtain even more purchasing stress, which causes greater rates( an uptrend ). When there’s anxiety, you’ll obtain even more marketing stress, which causes reduced rates( a sag). You’re possibly questioning:” Will trend trading quit working?” Just if people have no feeling( which is not likely ). Therefore, you can anticipate fads to happen in any type of markets like foreign exchange, futures, supplies, bonds, farming, and so on 30-Year Treasury Bond:

Technique

with PrimeXBT USD/JPY: Amusing truths: Jesse Livermore, one of the most renowned investor of perpetuity, made $ 100 million in 1929. Richard Dennis, the owner of the turtle investors, made $ 400 million trading the futures market. Ed Seykota, potentially the very best investor of our time, accomplished a return of 250,000 %, over a 16 year duration. Do you understand what they share? They embrace a pattern trading technique. Just how to specify patterns like a professional You possibly recognize … An uptrend includes greater low and high. As well as sag contains reduced low and high, right? However … suppose you obtain a graph that appears like this? Is this an uptrend, array, or sag? Uh oh. As well as this is the issue when you specify patterns utilizing greater low and high– there is subjectivity included. So, what can you do? You can utilize the 200-period relocating standard( MA) to assist you with it.

Below’s just how … If the cost is over 200MA and also

200MA is directing greater, after that it’s a long-lasting uptrend. If the cost is listed below 200MA and also 200MA is directing reduced, after that it’s a lasting sag. An instance:

Currently, the following point you need to understand is … Patterns can feed on various durations Below’s the important things: Relying on the duration you get on, a market

can have various fads on various durations. Below’s what I indicate … Sag on once a week: Uptrend on 4-hour: Currently … A blunder investors make is trading patterns on every duration. This is a large NO. Rather, you need to trade fads on your picked duration. This indicates

: If you’re trading the Daily, after that your work is to trade fads on the day-to-day duration.

If you’re trading the per hour, after that your work is to trade fads on the per hour duration

. If you’re trading the 5 mins, after that your work is to trade fads on the 5 mins duration. Obtain

it? Currently to take points an action additionally … You can incorporate pattern trading as well as several duration evaluation

to boost your trading outcomes. 3 sorts of fads every severe investor have to recognize A lot of investors presume a

pattern just

contains greater low and high. Yet it’s

insufficient due to the fact that fads are not developed equivalent. Some are far better to trade outbreaks, and also some to trade

pullbacks. So in this area, you will certainly discover the 3 kinds of patterns( that a lot of investors are not aware of ), and also the very best means to trade each of

them. They are:. Solid fad Healthy and balanced pattern Weak pattern Solid pattern– In this kind of pattern, the purchasers remain in control with little marketing stress. You can anticipate this kind of pattern to have superficial pullbacks

— hardly backtracking past the 20MA. Sometimes, you will certainly obtain no marketing stress as the pattern goes allegorical.

Healthy and balanced pattern– In this sort of pattern

- , the customers are

- still in control with the

existence of offering stress (perhaps because of investors taking earnings, or investors wanting to take counter-trend arrangements). You can anticipate this kind of fad to have a respectable retracement normally in the direction of the 50MA, which gives a possibility to get on board the fad.

Weak pattern — In this sort of fad, both customers as well as vendors are trying control, with the customers having a mild benefit. You can anticipate the marketplace to have high pullbacks and also often tends to trade past the 50MA. When is the very best time to go into a fad Right here’s a truth: There are 2 means to go into a fad, on an outbreak or pullback. As well as the access technique

you’re going to utilize relies on the kind of pattern the marketplace remains in. Allow me clarify … Solid pattern In a solid fad, the marketplace has superficial retracement( not surpassing 20MA )that make it hard to enter upon a pullback due to the fact that the marketplacerarely backtracks and afterwards proceeds pressing

greater. Hence the most effective method

to trade this kind of pattern gets on an outbreak or, to discover an entrance on the reduced duration. An instance:

Healthy and balanced fad In a healthy and balanced pattern, the marketplace has a good retracement that makes it perfect to enter upon a pullback.

Nevertheless, you

can likewise get in

on an outbreak. However you’ll need to “sustain” the retracement back in the direction of 50MA( which drains your psychological resources).Hence, a much better access is to enter upon a pullback. Below’s what I indicate:

Weak pattern In a weak fad, the marketplace has high retracement( normally surpassing 50MA) and also it’s hard to” anticipate” where the retracement will certainly finish utilizing MA

. Likewise: In a weak uptrend, the marketplace often tends to damage the highs just to backtrack back a lot reduced (that makes trading outbreak challenging ). Hence, the most effective means to enter this kind of pattern goes to Assistance as well as Resistance.

An instance:

Exactly how to establish your quit loss in a trending market Whenever I place on a quit loss, I would certainly consider this quote … Area your quits at a factor that, if gotten to, will fairly show that the profession is incorrect. Not at a factor established largely by the optimal buck amount you agree to shed– Bruce Kovner So, right here are 3 means you can do it:. Relocating typical Framework Trendline Allow

me describe … Relocating ordinary The secret below is to make use of theMA that is valued by the markets. For instance: In a solid trending market, rate often tends to appreciate the 20MA. Hence, you must put your quit loss listed below the 20MA. As well as if it damages, you understand your trading concept is incorrect.

PrimeXBT review Or … If rate has a tendency to value the 50MA, after that position your quit loss past 50MA. Framework Below’s things … An uptrend includes greater highs( and also lows ), as well as a drop includes reduced highs (as well as lows ). So, below’s what you can do: Uptrend– you can put your quit loss listed below the previous

reduced Drop– you can position

your quit loss over the previous

high An instance: Trendline Below’s a two-step procedure in operation trendline:. Attract trendlines by attaching the lows of an uptrend( as well as highs of a drop). As soon as you have actually recognized the” obstacle”, you can establish your quit loss listed below the trendline( for uptrends), as well as over the trendline (for drops). Below’s what I suggest:Method with PrimeXBT Currently you’re possibly asking yourself:” Where precisely do I establish my quit - loss?” Currently … You do

n’t

wish to establish your quits besidethe trendline( or framework )since you can obtain

quit outtoo soon. Also, you do not intend to position it as well away, which injures your danger to compensate. Therefore, you can establish your quit loss 1 or 2 ATR far from the framework which offers your profession sufficient “space to take a breath”. Exactly how to establish

a pattern trading method Allow’s be clear: A fad trading approach is just 1/3 of the formula. Without appropriate threat monitoring and also technique, also the very best trading approach isn’t mosting likely to make you cash over time. Currently … Whenever I create a pattern trading method, it

requires to respond tothese 7 concerns:. Which markets you trading What’s the duration you’re trading What are the problems of your trading configuration What is your entrance trigger Where is your quit loss Exactly how will certainly you leave your victors

Just how will certainly you

handle your profession Markets Traded Farming products Money Equities Fees Non-Agriculture Commodities Fad trading

- method layout If the marketplace (on the Daily duration) is a healthy and balanced pattern, after that await it to pullback in the direction of 50MA. If the marketplace pullback in the direction of

- 50MA, after that wait on a candle light to enclose your support If the candle light encloses your

- support, after that want to enter upon following candle light If

you enter upon following- candle light, after that establish your quit

- loss 2 ATR from access If quit loss is established,

- after that aim to

- take revenue at the local swing high/low **

Please note: I will certainly not be in charge of any type of

earnings or loss arising from making use of these trading methods. Previous efficiency is not an indicator of future efficiency

. Please do your very own due persistance prior to risking your difficult generated income. Shedding profession at (JP225USD): Winning profession at( EUR/NZD): Winning profession at (NZD/CAD): Regularly asked inquiries # 1: I’m puzzled when you claim fad trading rises your win-rate. Would not trend trading reduce your win-rate due to the fact that a lot of markets have a tendency not to trend a lot of the moment? There’s a distinction in between pattern trading as well as fad following. Fad trading merely implies trading with the fad. You can be a swing investor in a trending market. Whereas for pattern complying with, you’re trying to catch the complete pattern by tracking your quit loss. So indeed, pattern trading rises your win-rate as you’re trading along the course of the very least resistance, contrasted to somebody

trading versus the fad. Nonetheless, do

n’t puzzle that with pattern complying with, which is an effort to ride the whole fad. # 2: If the cost is listed below the 200 MA in the reduced duration however over the 200 MA in the greater duration, should we treat this market as an uptrend or a sag? You must constantly take notice of the pattern of the duration you’re trading on: If you’re trading on the 5-minute duration as well as it remains in a sag, after that you need to claim the marketplace remains in a drop. If you’re trading on the everyday duration, after that you

ought to take notice of the pattern on the everyday duration. If the durations are also much apart, after that it’s pointless. Since it does not make good sense to be adhering to the pattern on the everyday duration if you’re trading on the 5-minute duration. At a lot of, you can think about the fad one duration more than what you’re trading. As an example, if you trade on the everyday duration, you can take into consideration the pattern on the regular duration to ensure the fad lines up. # 3: Just how can I recognize if it’s mosting likely to be

simply a pullback or a turnaround entirely? On a pullback, the series of the candle lights

is reasonably little. Whereas on a turnaround, the series of the candle lights obtains bigger and also the rate has a tendency to damage essential market

frameworks, like previous swing lows or location of assistance. Likewise, if the rate develops a collection of reduced highs as well as reduced lows, after that opportunities are, the marketplace will certainly go into an array or turn around entirely. A fast wrap-up of what you have actually found out Pattern trading boosts your win price, enhances your danger to compensate, as well as can be used throughout all marketsYou can specify the lasting pattern utilizing the 200-period relocating ordinary In a solid pattern, it’s optimal to enter your professions on an outbreak (or on a reduced duration )In a healthy and balanced fad, it’s excellent to enter your professions on a pullback( in the direction ofthe relocating standard) In a weak pattern, it’s excellent to enter your professions at Assistance or Resistance In a trending market,

you can establish your quit loss utilizing relocating standard, trendline, or framework Currently right here’s what I such as to understand … Do you comply with a pattern trading method? What’s your experience with it? Leave a remark listed below and also allow me understand. Pattern Trading Technique with PrimeXBT

Fad Trading Technique with Primexbt review Fad Trading Approach with PrimeXBT Pattern Trading Approach with PrimeXBT Pattern Trading Approach with PrimeXBT Pattern Trading

Approach with PrimeXBT Fad Trading Technique with- PrimeXBT Pattern Trading Technique with PrimeXBT Pattern Trading Method with PrimeXBT Pattern Trading Method with PrimeXBT Fad Trading Approach with PrimeXBT Pattern Trading Approach with PrimeXBT Fad Trading Method with PrimeXBT Fad Trading Method with PrimeXBT Pattern Trading Technique with PrimeXBT Pattern Trading Approach with

- PrimeXBT Pattern Trading Method with PrimeXBT Pattern Trading Method with PrimeXBT Fad Trading Method with PrimeXBT Pattern Trading Technique with PrimeXBT Fad Trading Approach with PrimeXBT Pattern Trading Method with PrimeXBT Pattern Trading Approach with PrimeXBT Pattern Trading Approach with PrimeXBT Pattern Trading Technique

with PrimeXBT Fad Trading Method with

PrimeXBT Pattern Trading Method with PrimeXBT Fad Trading Method with PrimeXBT

Fad Trading Approach with PrimeXBT Fad